How I fell down the blockchain rabbit hole and went from normie to noob.

I was familiar with the Bitcoin headlines, the term blockchain, and more recently non-fungible tokens or NFTs. The $69 million dollar sale of Beeple’s ‘Everydays’ at a Christie’s auction registered a blip on most people’s radar, and introduced the acronym NFT to non-blockchain enthusiasts. It was hard not to be aware that people were paying big money for jpegs, something that most people consider free. But there was more to it than the sensationalized headlines as I was to discover.

Now there are many new concepts with emerging technology and it took me a while to get my head around them, and I am still learning more everyday. But understanding ideas like decentralization, blockchain, cryptocurrencies, and smart contracts are essential to keeping up with the tech. I will summarize as best I can, how I understand it.

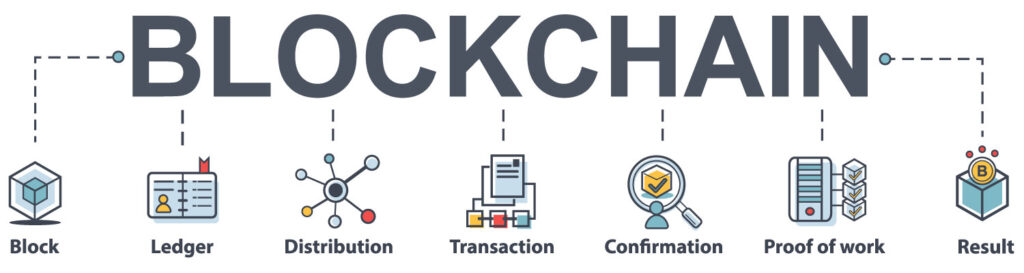

At the core is the concept of a decentralized system that removes any one single stakeholder. This is the idealized concept that exists to varying degrees. A blockchain is a book of records, aka the ledger, that is controlled by thousands, maybe millions of computers that store the information and confirm it’s veracity. Crypto currencies are the tender of a specific blockchain and its value reflects the network’s adoption and usage. And then smart contracts are agreements written in code on a blockchain that can automatically be executed when certain conditions are met.

Therefore using blockchain technology, one can write something to the ledger, create unique digital stuff, sometimes referred to as tokens, and document ownership. As long as the lights stay on, and the computer nodes that make up a given network are plugged in, the record of ownership of any item, digital or not, can be verified and exists forever. In addition the smart contracts can be written to govern the tokens, and do things like pay royalties to original creators that automatically occur on a resale. Head spinning yet?

First came Bitcoin which is only a store of value, but then came Ethereum which enabled developers to create programs on a blockchain, and now there are dozens of competing blockchains with different approaches, with their own currency to incentivize the network, because someone has to pay for the electricity. (More on this in a later post)

I first became aware of these ideas a few years back when Nye talked my ear off about Crypto Kitties and the idea of verifying ownership of digital assets. I remember reading up on it and learning how each one was entirely unique, and that owners could breed them to create other unique non-fungible kitties. I thought it was a cool game mechanic but I left it at that.

Flash forward to earlier this year and I saw that Beeple, artist Mike Winkelmann, was selling his art as NFTs. (This was before the Christie’s auction) He was offering his artwork as NFTs, but was creating slick packaging to help bridge the gap between a physical collectible and digital artwork. If you didn’t fully grasp the concept of digital ownership, you still got a physical thing.

Around the same time I learned about Crypto Punks, one of the first collections of generative art profile pictures, or PFPs, also referred to as avatars. Crypto Punks were a creation of Larva Labs and the 10,000 pieces of algorithmically generated pixel art characters committed to the blockchain were given away for free in 2017. The intriguing concept, in addition to proof ownership being tracked on the Ethereum blockchain, was that the images were randomly assembled from a list of visual traits, and every single one was unique. Programmatically generated art is an important and reoccurring theme in digital art. These now blue chip NFTs resale for an average of $360,000 each. Punks have reached the pinnacle of popularity in the space and the team has recently signed on with the entertainment talent agency UTA.

In May of this year Nye and I came across another 10k generative project called the Bored Ape Yacht Club, or BAYC. They were these awesome illustrations of cartoon apes. Both of us said cool, let’s pick one up. They were offered for .08 Eth at minting, the term for documenting a new thing to the blockchain, but we never did. As of this writing the current value of the least expensive ape is around 35 Eth, or $130,000. Missed opportunity, oh well. But the interesting thing about this project to us was the movement towards added utility. The creators, Yuga Labs, were not just offering cool artwork on chain, but a membership to a club. How it would be manifested was to be determined, but as this market for NFTs has grown, the communities that are formed around ownership have been integral to a project’s success. Yes it is art, but it is art with benefits.

When Gary Vaynerchuck, entrepreneur and influencer, announced his project called VeeFriends, I figured maybe I would participate in the offering. To do so I created a non custodial wallet and bought some crypto, both a prerequisite for purchasing anything on a blockchain. When the details came out, price structure and utility, I had second thoughts. I loved his take on utility for the token, they doubled as a ticket to his soon to be created conference, but I could not commit to travel to unknown times and places of the events. In addition the price, with Ethereum near its all time high, seemed like a lot. “How much for a jpeg?” I imagined my wife saying. So I didn’t buy one.

At this point I had Etherum burning a hole in my non custodial wallet, and I began looking for interesting projects that I could afford. That’s when I came across the Visitors of Imma Degen, or VOID, and I began to see the potential of where projects might go.

At the time, there were very few 3d avatar projects, most were 2D cartoon characters of animals. A lot seemed like retreads of other projects. But VOID, in addition to a high resolution render, were offering the 3D models of your purchased Degen. As an artist who works daily with 3D software, I saw this as a real bonus and added utility. So I bought one for the studio. Then we bought 2 more.

After downloading the geometry of our Degens, I started messing around and dropped some animation on the characters in Maya on a simple rig, kit bashed some stuff together in the Unreal Engine, then posted my derivatives on twitter.

The community response was great, and when I engaged with VOID collectors I started to see other creators using their own VOIDs to make content. Making derivative art is a big part of these communities, be it memes or full blown pieces that are minted and resold. In fact, many projects give you full commercial rights to the token you buy, and artists who sell their derivatives are encouraged and supported by the community.

The next step was to actually make an NFT. Dip our toes in the blockchain waters so to speak. So both Nye and I experimented with different platforms. Nye minted our Founders’ token on NiftyKit which allows you to customize your contract on the polygon network, and I lazy minted an animated Box Rocket Bot “Cheers!” on OpenSea with Ethereum.

A large portion of the current NFT market is what I would call collectibles with benefits. In addition to being used as a digital identity on social networks and in the emerging metaverses, they can also be used as unique identifiers which can provide access and assets to holders on line and in real life. It can be even more than this of course, and it is evolving. Some of the best use cases are still out there, not just when you consider how games and metaverses will integrate ownable digital assets into their platforms, but how a shared intellectual property can be leveraged by the crowd to create new and interesting content and revenue models.

With that in mind we are building, because we believe there is opportunity for novel approaches, and at this point I am too far down the rabbit hole to climb back up. Stay tuned for more….